Ganacsiga Aasaasiga ah ee IQ Option: Faafinta, Isbeddelka, Margin, Leverage, Beddelka

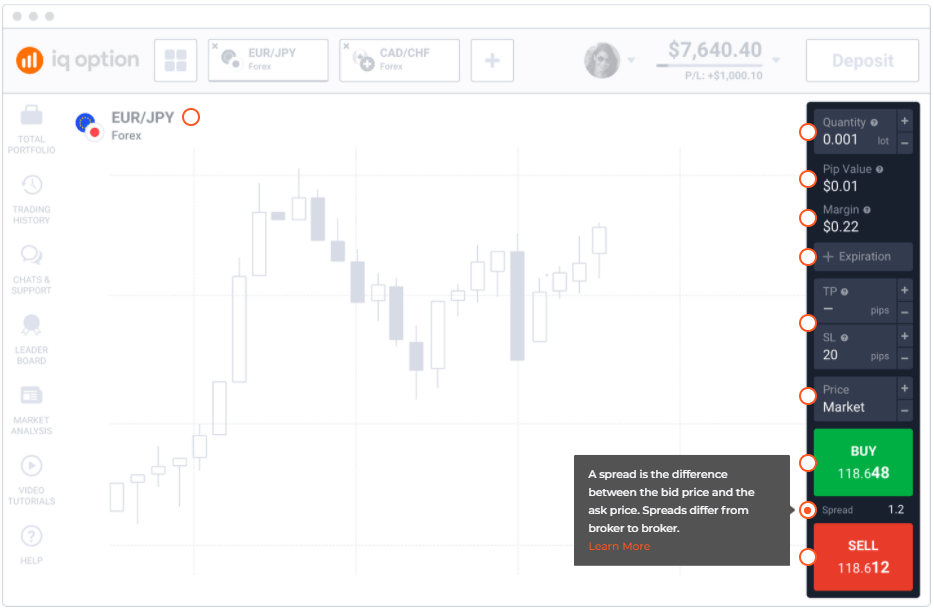

Faafiyo

Faafintu waa faraqa u dhexeeya qiimaha dalabka iyo qiimaha weydiinta. Faafidu way ka duwan tahay dullaal ilaa dilaal.

Si loo xisaabiyo qiimaha faafinta goobta IQ Option, isticmaal qaacidooyinka soo socda:

Qiimaha faafinta = Cabbirka badan × Cabbirka qandaraaska × Faafin

Tusaale EUR

/USD Weydii: 1.13462 Bid: 1.13455

Faafidda: 1.13462 – 1.13455 = 0.00007 Baaxadda

ganacsiga: 2 lots

Cabbirka qandaraaska: 100.000 unug ee lacagta saldhiga ah (=200,000 oo ah lacagta saldhiga ah ) × 100.000 = 14 USD

Isku-beddelasho

Isdhaafsigu waa lacag ribo ah oo uu ganacsaduhu ku qasban yahay in uu u bixiyo dullaal si uu jagooyin u hayo habeen.

Isdhaafsiga ayaa ka dhasha kala duwanaanshaha heerka dulsaarka lacagaha oo lagu daray khidmadda maamulka dulaalka. Ganacsiga forex-ka, waxaad amaahatay hal lacag si aad u iibsato mid kale. Isku bedelashadu waxay ku xidhan tahay inaad iibsato lacag leh dulsaar sare ama ka hooseeya marka loo eego lacagta aad amaahatay. Isbeddelku wuxuu noqon karaa mid togan iyo mid xun.

Haddii aad iibsato lacag leh dulsaar ka sarreeya ta amaahda, waxaad heli doontaa beddelaad togan. Aynu eegno tusaalaha soo socda.

Tusaale

dulsaarka Maraykanku waa 1.75%.

Heerka dulsaarka Australia waa 0.75%.

Kharashka maamulka waa 0.25%.

Haddii aad boos dheer ka furto labada lamaane ee USD/AUD, isdhaafsiga 0.75% ayaa lagu xisaabin doonaa akoonkaaga, maadaama lacagta aad iibsatay (USD) ay leedahay dulsaar ka sareeya lacagta aad amaahatay (AUD).

Haddii aad boos gaaban ku furto isla lacag isku mid ah, isku beddelasho ah 1.25% ayaa lagaa saarayaa akoonkaaga, sababtoo ah lacagta aad amaahatay (USD) waxay leedahay dulsaar ka sarreeya lacagta aad iibsato (AUD).

Margin

Margin waa qadarka lacagta ganacsadaha looga baahan yahay si uu u furo boos leveraged. Margin wuxuu kuu ogolaanayaa inaad ku ganacsan karto leverage, kaas oo asal ahaan isticmaalaya lacagaha laga soo amaahday dilaal si loo kordhiyo xajmiga ganacsigaaga.

Si aad u xisaabiso margin goobta IQ Option, isticmaal qaacidooyinka soo socda:

Margin = Cabbirka fara badan × Cabbirka qandaraaska / Leverage

Tusaale

Waxaad damacsan tahay inaad ku iibsato 0.001 badan (1,000 unug) oo ah lacagta EUR/USD oo leh 1:500 leverage. Xadka loo baahan yahay si loo furo booskan ganacsi waa 0.2 EUR. Fiiri xisaabinta faahfaahsan ee hoose:

Lammaanaha lacagta: EUR/USD

Cabbirka Lot: 0.001 lot

Leverage: 1:500

Cabbirka qandaraaska: 100,000 unug ee lacagta saldhigga ah

Margin = 0.001 × 100,000 / 500 = 0.2 EUR

Fadlan ogow in beddelaaddu ay khusayso haddii aad lacagta xisaabtu way ka duwan tahay lacagta aasaasiga ah.

Ka faa'iidaysiga

Leverage waxay kuu ogolaanaysaa inaad ka ganacsato jagooyin ka weyn cadadka raasumaalka aad leedahay. Leverage waxay kordhisaa lacag bixinta, laakiin sidoo kale waxay kordhisaa khasaaraha.

Tusaale

Aan ka soo qaadno inaad ku shubtay $1,000 akoonkaaga oo aad isticmaalayso 1:500 leverage. Xaaladdan oo kale, awooddaada wax iibsiga waxay kordhin doontaa 500 jeer, ilaa $ 500,000, taas oo macnaheedu yahay inaad dhigi karto ganacsi qiimihiisu yahay $ 500,000.

Fadlan ogow in faa'iidada ay ku kala duwan tahay hantida kala duwan.

Beddelka

Heerarka beddelka lacagta ayaa laga yaabaa in lagu dabaqo xaaladaha qaarkood. Tani waxay dhacdaa iyada oo ay ugu wacan tahay xaqiiqda ah in halbeeg kasta oo ganacsi ah lagu tilmaamo mid ka mid ah lacagta aasaasiga ah ama lacagta xiga. Cabbirka qandaraaska iyo margin waxaa lagu qiimeeyaa lacagta aasaasiga ah, halka bixinta had iyo jeer lagu xisaabiyo lacagta xigashada. Sidaa darteed qiimaha beddelka lacagta ayaa laga yaabaa inay dalbato xisaabinta margin iyo lacag bixinta. Haddii lacagta akoonkaaga ay ka duwan tahay lacagta xigashada, beddelaad ayaa lagu dabaqi doonaa. Aynu eegno tusaalooyinka soo socda si aan u fahanno marka lacagta beddelka loo baahan karo.Tusaale 1: Lacagta saldhiga = lacagta xisaabta

Aynu ka soo qaadno in lacagta akoonkaaga ay tahay USD oo aad ka ganacsanayso labada lamaane ee USD/JPY. Beddelku ma dabaqi doono marka la xisaabinayo margin, maadaama lacagta saldhiga ah (USD) ay la mid tahay lacagta xisaabta (USD). Beddelku wuxuu khuseeyaa marka la xisaabinayo lacag bixinta: marka hore, waxaa lagu xisaabin doonaa JPY, lacagta xigashada, ka dibna loo beddelo USD, lacagta xisaabta.

Tusaale 2: Xigasho currency = Lacagta xisaabta

Aynu ka soo qaadno in lacagta akoonkaaga ay tahay USD oo aad ka ganacsanayso lammaanaha lacagta EUR/USD. Beddelku wuxuu dabaqi doonaa marka la xisaabinayo margin, maadaama lacagta aasaasiga ah (EUR) ay ka duwan tahay lacagta xisaabta (USD). Beddelku ma khuseeyo marka la xisaabinayo lacag bixinta, sababtoo ah lacagta la soo xigtay (USD) waxay la mid tahay lacagta xisaabta (USD).

Tusaalaha 3: Ma jiraan wax tabar ah

Aynu ka soo qaadno in lacagta akoonkaaga ay tahay GBP oo aad ka ganacsanayso labada lacag ee AUD/CHF. Beddelku wuxuu dabaqi doonaa marka la xisaabinayo margin, sababtoo ah lacagta xisaabta (GBP) way ka duwan tahay lacagta aasaasiga ah (AUD). Beddelku waxa kale oo lagu dabaqi doonaa marka la xisaabinayo lacag bixinta: marka hore, waxa lagu xisaabin doonaa CHF, lacagta la soo qaato, ka dibna loo rogo GBP, lacagta xisaabta.

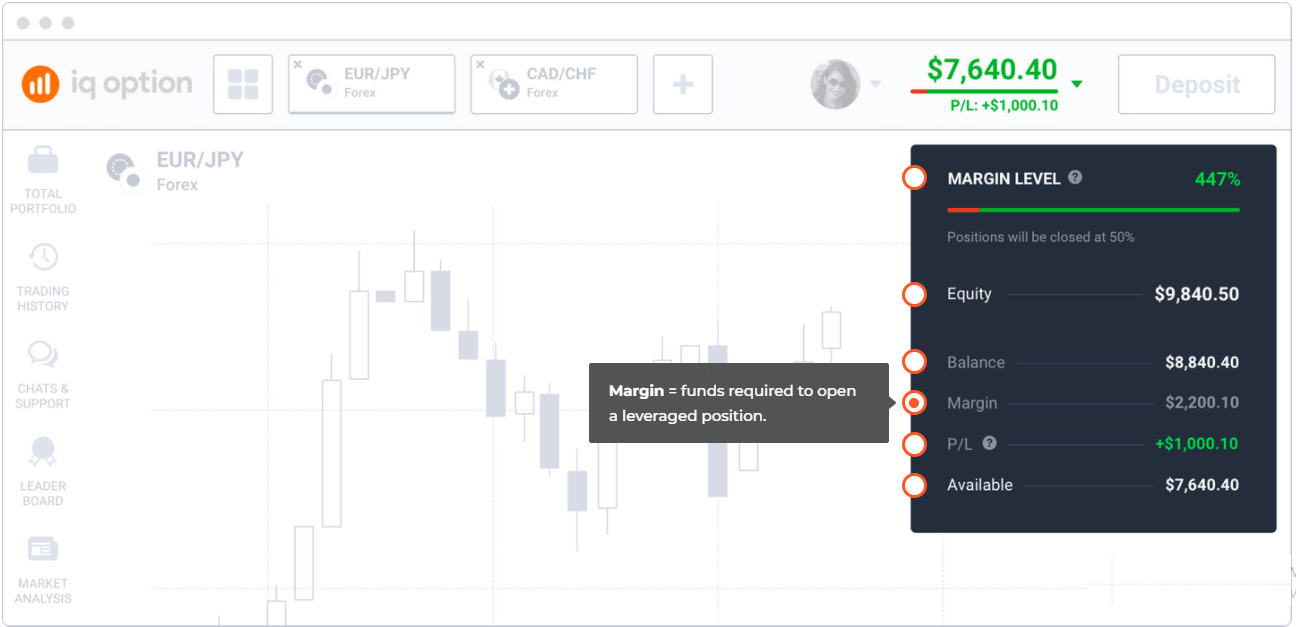

Heerka margin

Heerka margin wuxuu kaa caawinayaa inaad la socoto caafimaadka akoonkaaga: waxay tusinaysaa in wax waliba si fiican u socdaan iyo in kale waxayna kuu soo jeedinaysaa goorta aad xidhayso jagooyinka aan faa'iidada lahayn.

Si aad u xisaabiso heerka marginkaaga, isticmaal qaacidada soo socota:

Wax walba waxa lagu tilmaamay lacagta xisaabta:Heerka margin = Sinnaanta / Margin × 100%